First Time Home Buyers GST Rebate for Burquitlam Park District .

Posted on Jun 08, 2025 in Real Estate and Lifestyle

As part of the Government of Canada's initiative to help lower the upfront cost of buying a new home, a new GST Rebate has been announced!

Effective May 27th, 2025, First-Time Home Buyers Canada-Wide can take advantage of the FTHB Rebate here at Burquitlam Park District.

Effective May 27th, 2025, First-Time Home Buyers Canada-Wide can take advantage of the FTHB Rebate here at Burquitlam Park District.

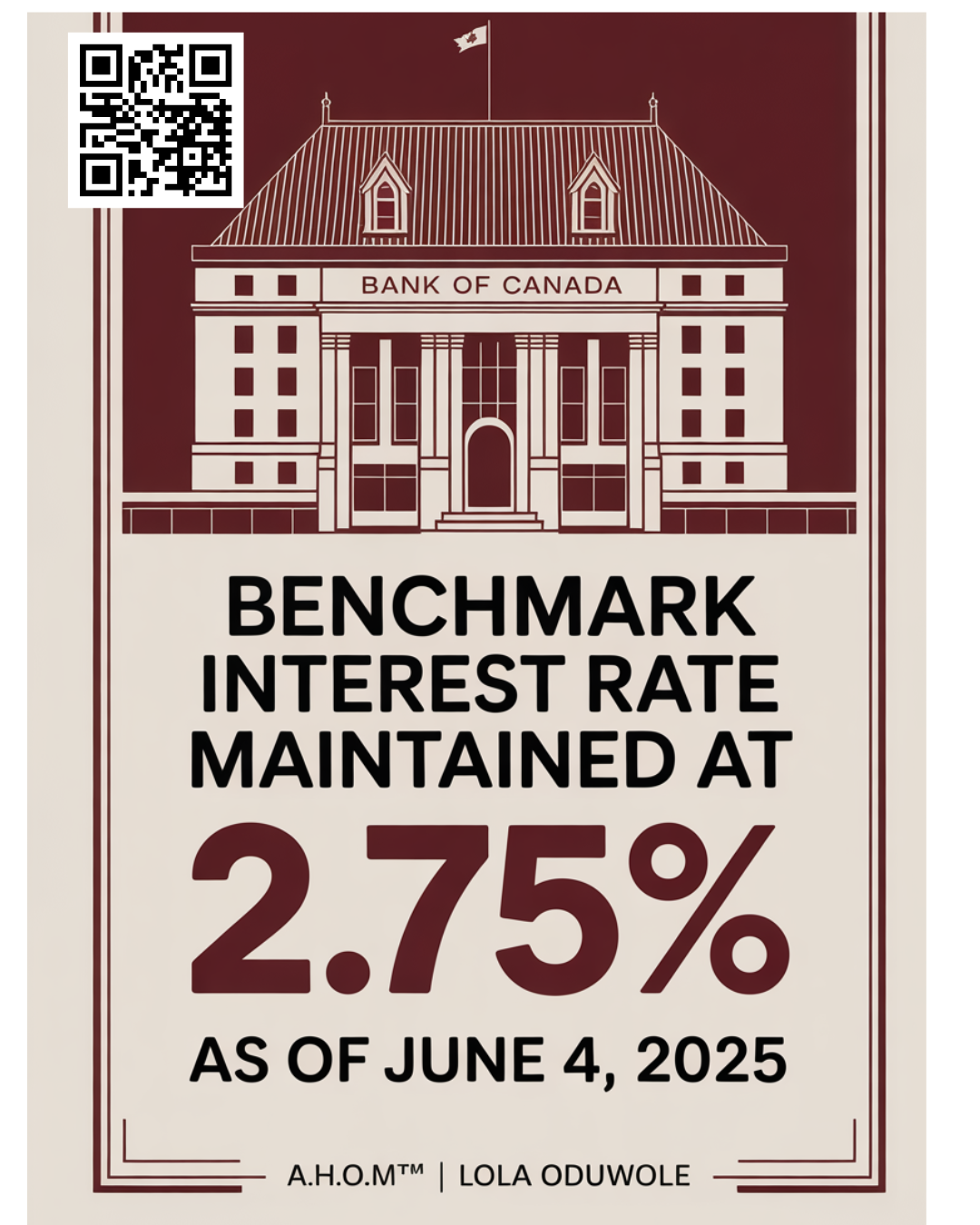

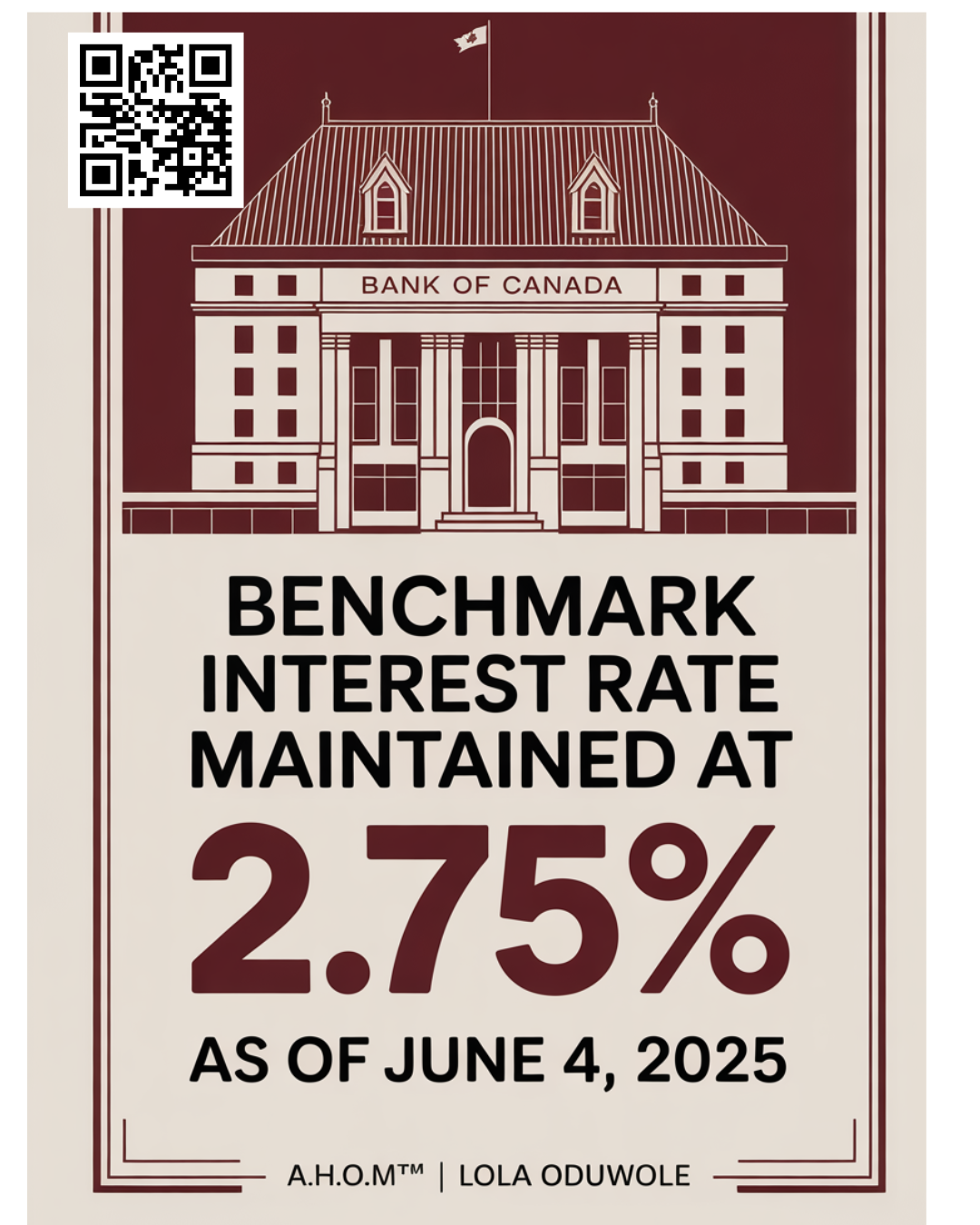

June o4, 2025...Bank of Canada holds rate steady at 2.75%

Posted on Jun 04, 2025 in Real Estate and Lifestyle

“Another rate hold. What does it mean for you? Here's what buyers and sellers need to know in plain English…”

“On June 4, the Bank of Canada held the benchmark interest rate at 2.75%...”

The Bank of Canada’s decision to hold the benchmark interest rate at 2.75% on June 4, 2025, carries significant implications for both buyers and sellers across the r...

Why Langley’s Jethro Condos Are a Smart Buy in 2025 — Especially If You’re Coming from Ontario

Posted on Jun 02, 2025 in Real Estate and Lifestyle

Because yes… they actually cash flow.Welcome to Jethro Condos in Downtown Langley. This chic, contemporary retreat is designed to combine the energy of city living with a sense of inspiration, creativity, and tranquility.

What I wish all Buyers Knew -- Its always about Positioning....not just price.

Posted on Jun 02, 2025 in Real Estate and Lifestyle

“This isn’t ONLY about price — it’s ALSO about positioning.”

Too often, buyers view real estate through one lens: price.

But the most successful moves are about alignment — not bargains.

But the most successful moves are about alignment — not bargains.

We talk so much about price in real estate that we forget what the buyer is really buying: a future, a lifestyle, a way of living.

Yes — price matters. But positioning...

Top Locations for Downsizing. Where to downsize in Ontario (and B.C)

Posted on Jun 01, 2025 in Real Estate and Lifestyle

One Message - 2 markets.

When you're ready to downsize, it's not about giving up.

It's about creating space for what matters most.

Whether your kids have moved out, you're ready to simplify, or you're dreaming of a lifestyle shift that feels more "you," the big question becomes: Where do I go now?

This guide was created to help you explore the best com...

When Builders go Bust : What every Pre-Construction Buyer needs to Know.

Posted on May 21, 2025 in Real Estate and Lifestyle

RESEARCH YOUR BUILDER - Do realtors actually research Builders?

Yes — the right ones do. Before recommending any pre-construction project, a good REALTOR® will:

- Verify the builder’s HCRA license

- Check Tarion (ON) or Licensing & Consumer Services (BC) for warranty enrollment, disciplinary history, and consumer alerts