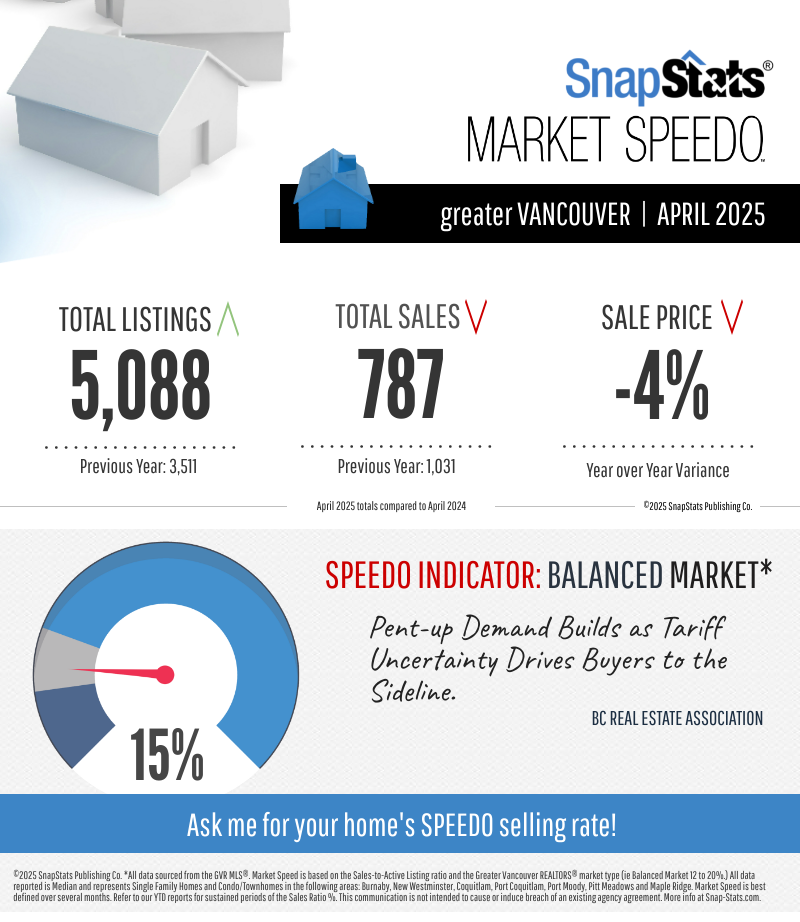

117 Buyers...$50m lost. Who's to blame?

Posted on May 21, 2025 in Real Estate and Lifestyle

The frustration was real.

The questions came fast:👉 Why wasn’t the builder licensed?

👉 Where was Tarion?

👉 If they used a REALTOR®, why weren’t they protected?

The questions came fast:👉 Why wasn’t the builder licensed?

👉 Where was Tarion?

👉 If they used a REALTOR®, why weren’t they protected?

They were talking about Sunrise Homes — the Ontario builder that walked away with $50 million in deposits from 117 families.And their concern was justified.Here’s what could’ve prevented it:✅ Ma...

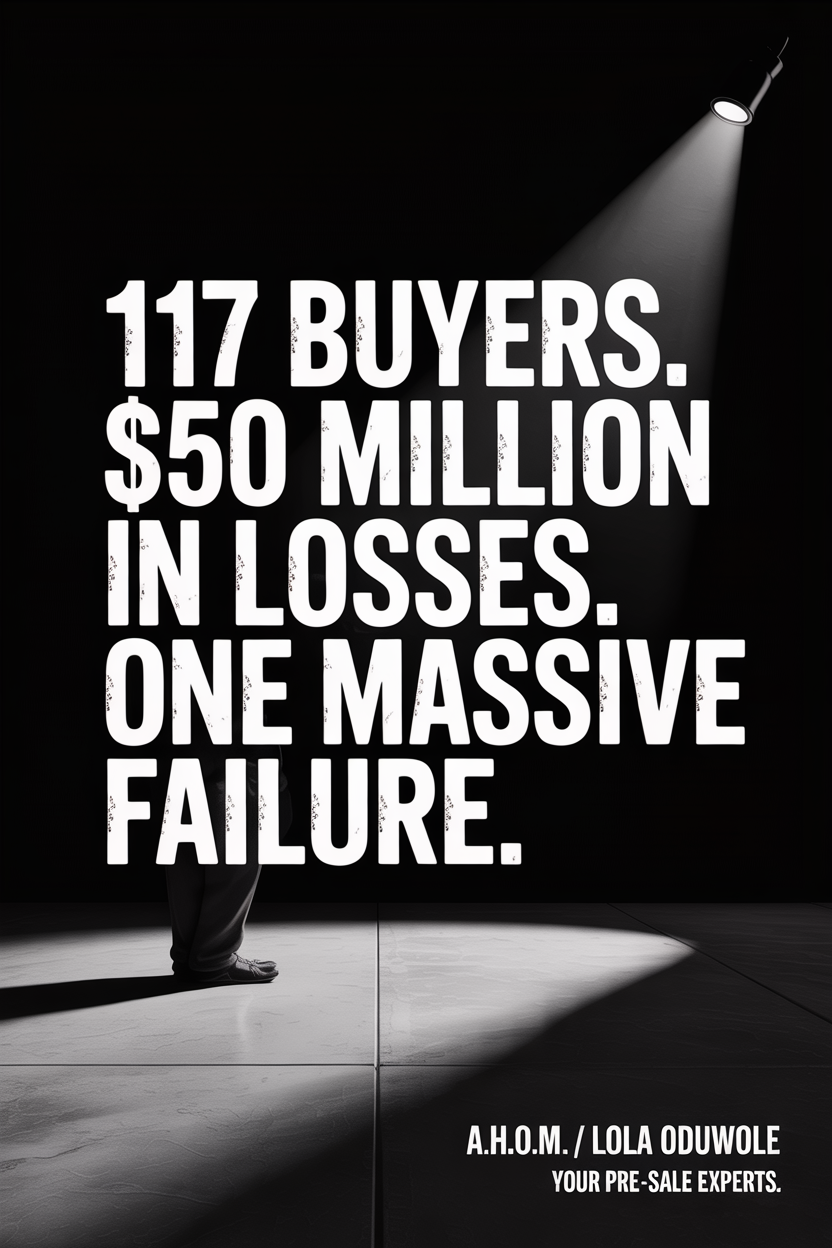

The Hidden Cost of Overpricing Your Home

Posted on May 20, 2025 in Real Estate and Lifestyle

What I Wish More Sellers Knew: Overpricing Your Home Helps the Competition

It’s natural to want top dollar when selling your home. You’ve invested time, money, and love into your space — and you want to be rewarded for it. But here’s the often-overlooked truth: pricing too high can actually cost you more in the end.

It’s natural to want top dollar when selling your home. You’ve invested time, money, and love into your space — and you want to be rewarded for it. But here’s the often-overlooked truth: pricing too high can actually cost you more in the end.

Why Overpricing Backfires

Overprici...

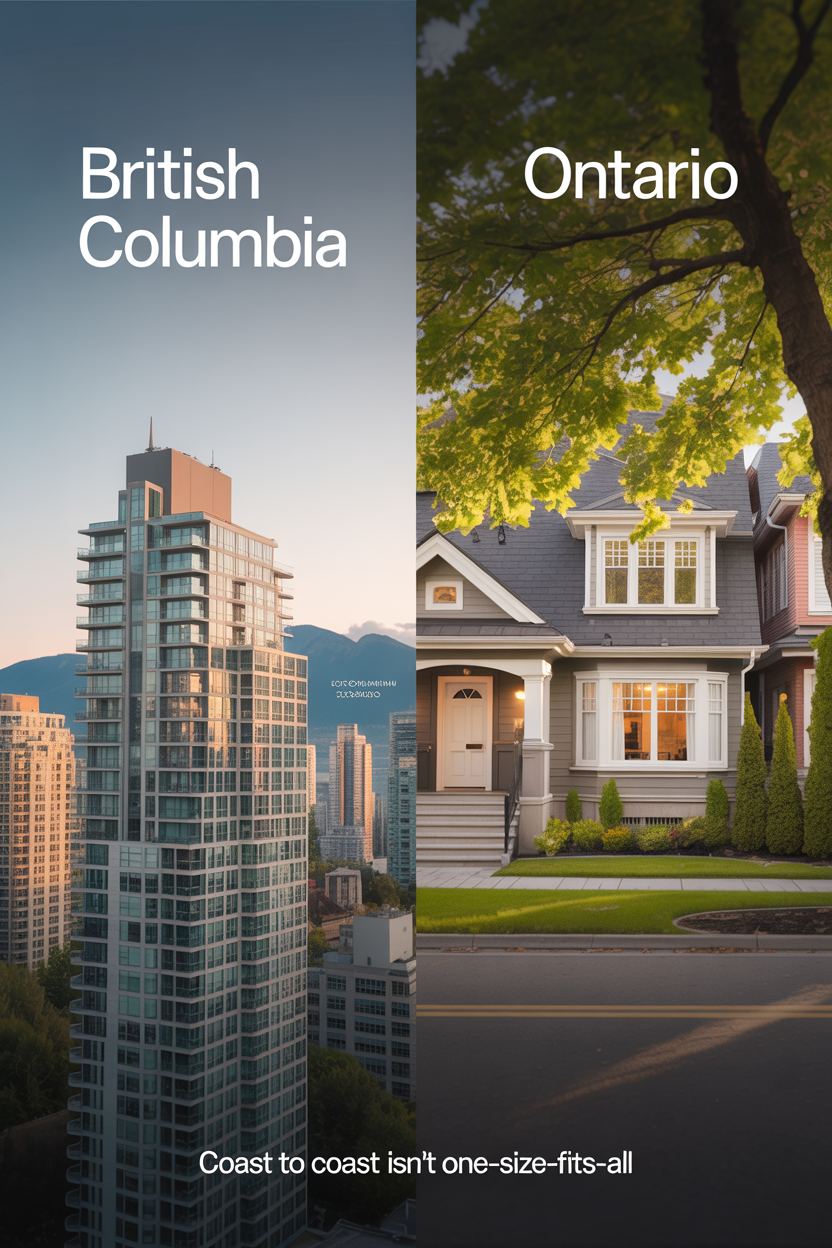

Coast to Coast isn't just a tagline...Its a Strategy.

Posted on May 06, 2025 in Real Estate and Lifestyle

As a dual-licensed REALTOR® in both British Columbia and Ontario, the question I’m asked most often is: “How do you manage both?”

It’s a fair question — and one that took me over two years to answer with intention.

Because the truth is: "Coast to Coast" isn’t just a tagline — it’s a strategy.

Real estate across Canada isn’t just about geography.

It’s a fair question — and one that took me over two years to answer with intention.

Because the truth is: "Coast to Coast" isn’t just a tagline — it’s a strategy.

Real estate across Canada isn’t just about geography.

It’s a...

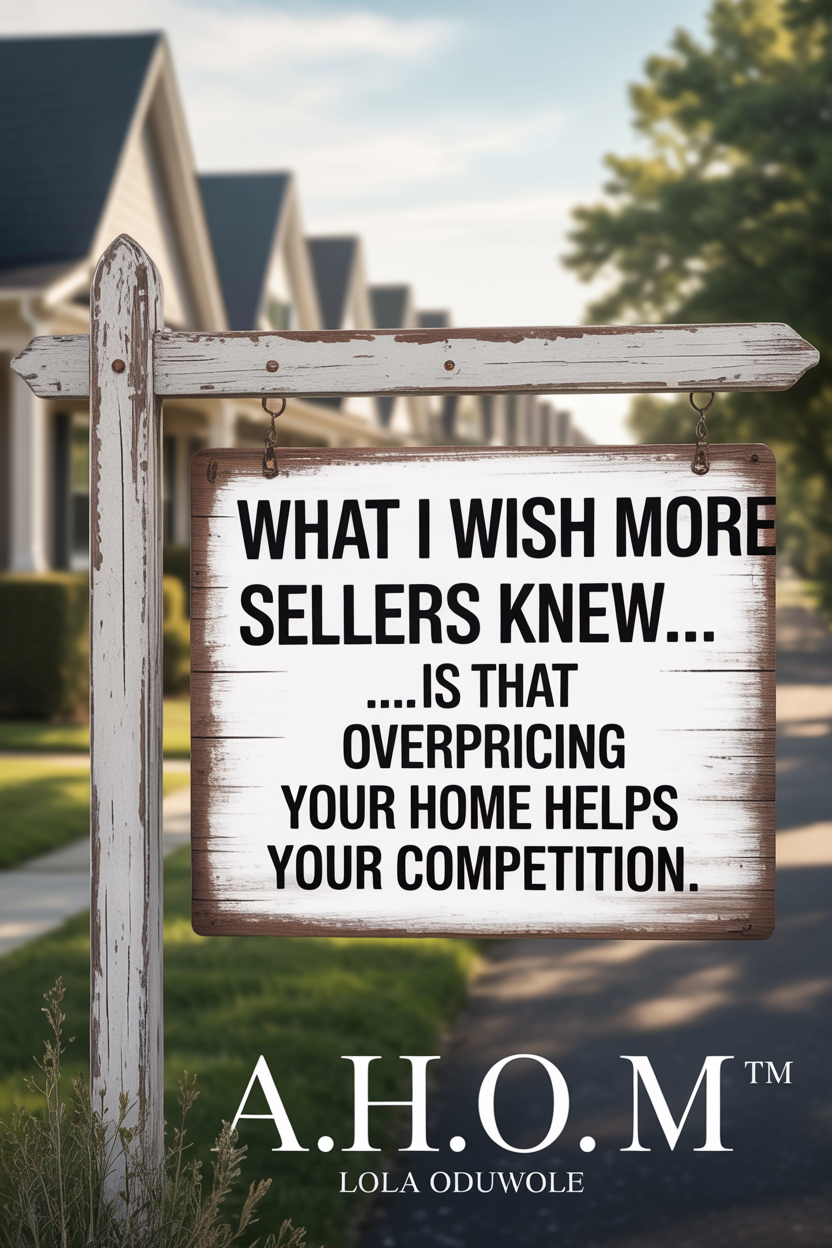

Considering Buying Pre-Construction? Start Here...

Posted on May 05, 2025 in Real Estate and Lifestyle

Pre-construction homes and condos can be a smart long-term move — but they require more than excitement and good timing. They require clarity, legal insight, and trusted guidance.

In this short visual guide, I’ve outlined the key things every buyer should know:

What you’re really buying (hint: it’s not just square footage)