CHMC - B.C and Ontario Condo market data reveal long term risks...Should you buy?

Posted on Jun 19, 2025 in Real Estate and Lifestyle

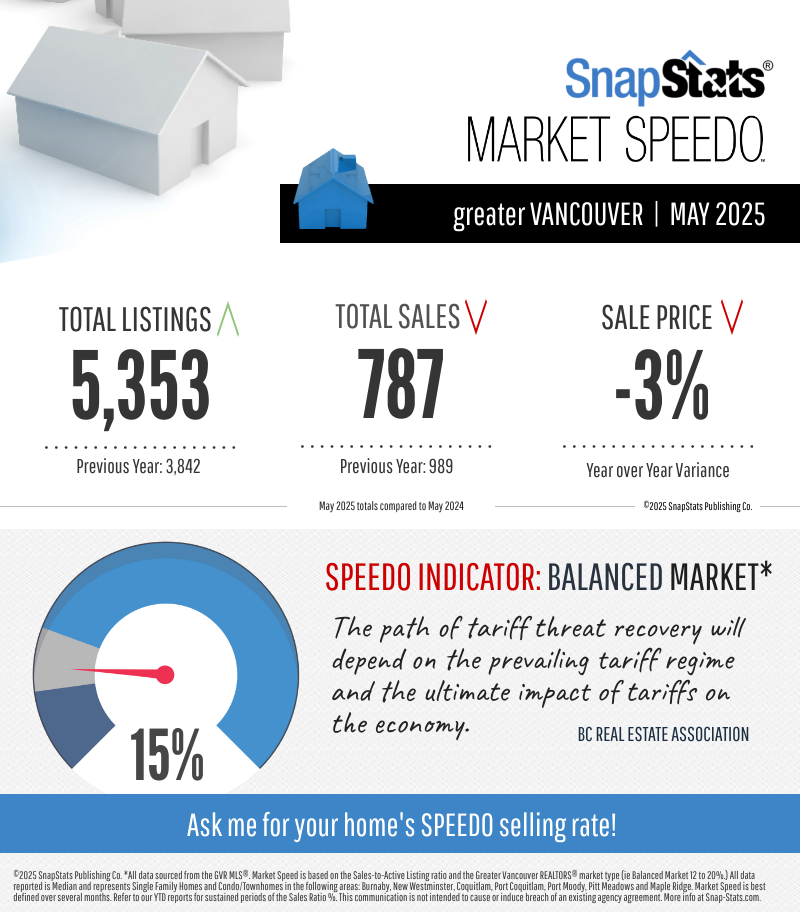

Between 2022 and 2025 (Q1), average resale condo prices declined by 13.4 per cent in Toronto and 2.7 per cent in Vancouver. Two years prior they had risen by more than 19 per cent in both locations.

Tenant expectations are shifting. Rental returns are narrowing.

And some regions are seeing more supply than demand. Whether you're a seasoned landlord o...

What I wish every Seller knew about what kills an Offer.....

Posted on Jun 17, 2025 in Real Estate and Lifestyle

What Kills an Offer? Insights Every Seller Should Know

When it comes to selling your home, the first offer might not always be the best — but it could be the right one. And in many cases, sellers unknowingly sabotage solid offers not because of price, but because of missteps in strategy, flexibility, or preparation.

When it comes to selling your home, the first offer might not always be the best — but it could be the right one. And in many cases, sellers unknowingly sabotage solid offers not because of price, but because of missteps in strategy, flexibility, or preparation.

Here are the top reasons I see off...

Renting in British Columbia VS Ontario. (One message...2 Markets... One You)

Posted on Jun 10, 2025 in Real Estate and Lifestyle

Renting in British Columbia vs. Ontario

What Every Tenant and Landlord Needs to Know (Before Signing Anything)If you're renting (or managing rentals) in Canada, you already know: where you live changes how you live.

And if you’re comparing British Columbia vs. Ontario, that difference isn’t just in mountain views or subway access — it’s written into...

Why Downsizing/Rightsizing may be the best move you will ever make.

Posted on Jun 08, 2025 in Real Estate and Lifestyle

It’s not just about letting go. It’s about moving into what fits now — with intention, grace, and clarity.

What Is Rightsizing — And How Is It Different from Downsizing?

The word downsizing often conjures images of sacrifice.Smaller space.

Fewer things.

Loss.

But rightsizing?

That’s a shift in perspective.

Rightsizing is the process of intentionally align...