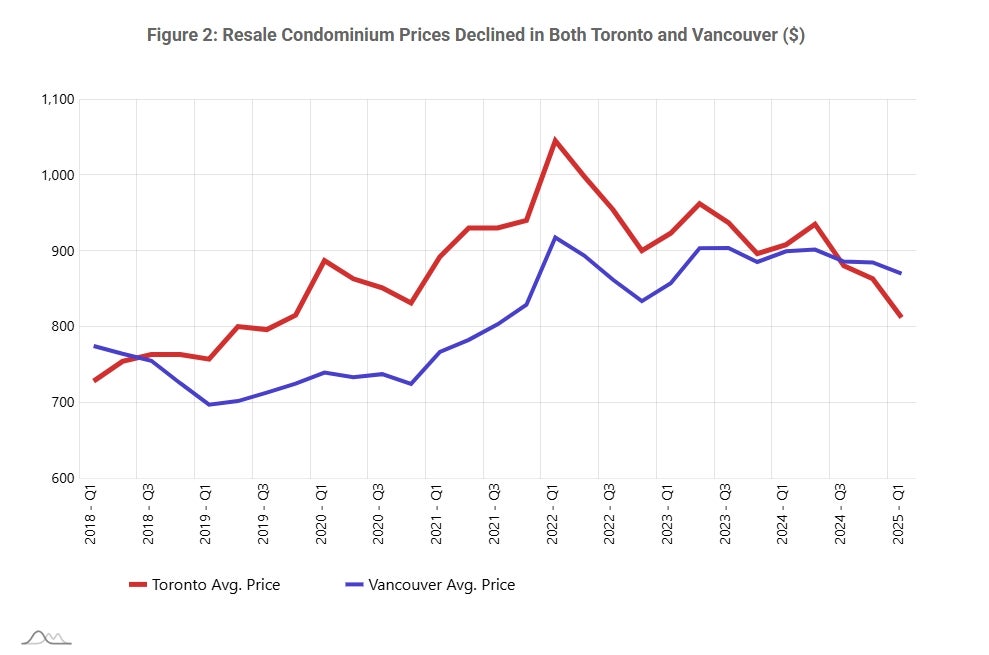

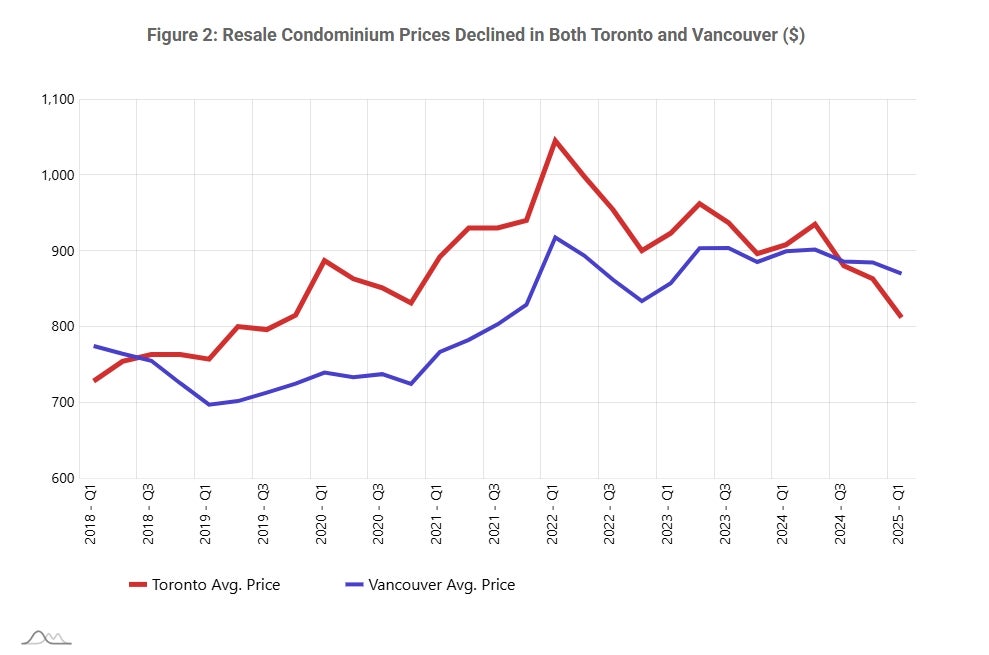

Between 2022 and 2025 (Q1), average resale condo prices declined by 13.4 per cent in Toronto and 2.7 per cent in Vancouver. Two years prior they had risen by more than 19 per cent in both locations.

📌 Save this if you manage a property or plan to become a landlord in 2025.

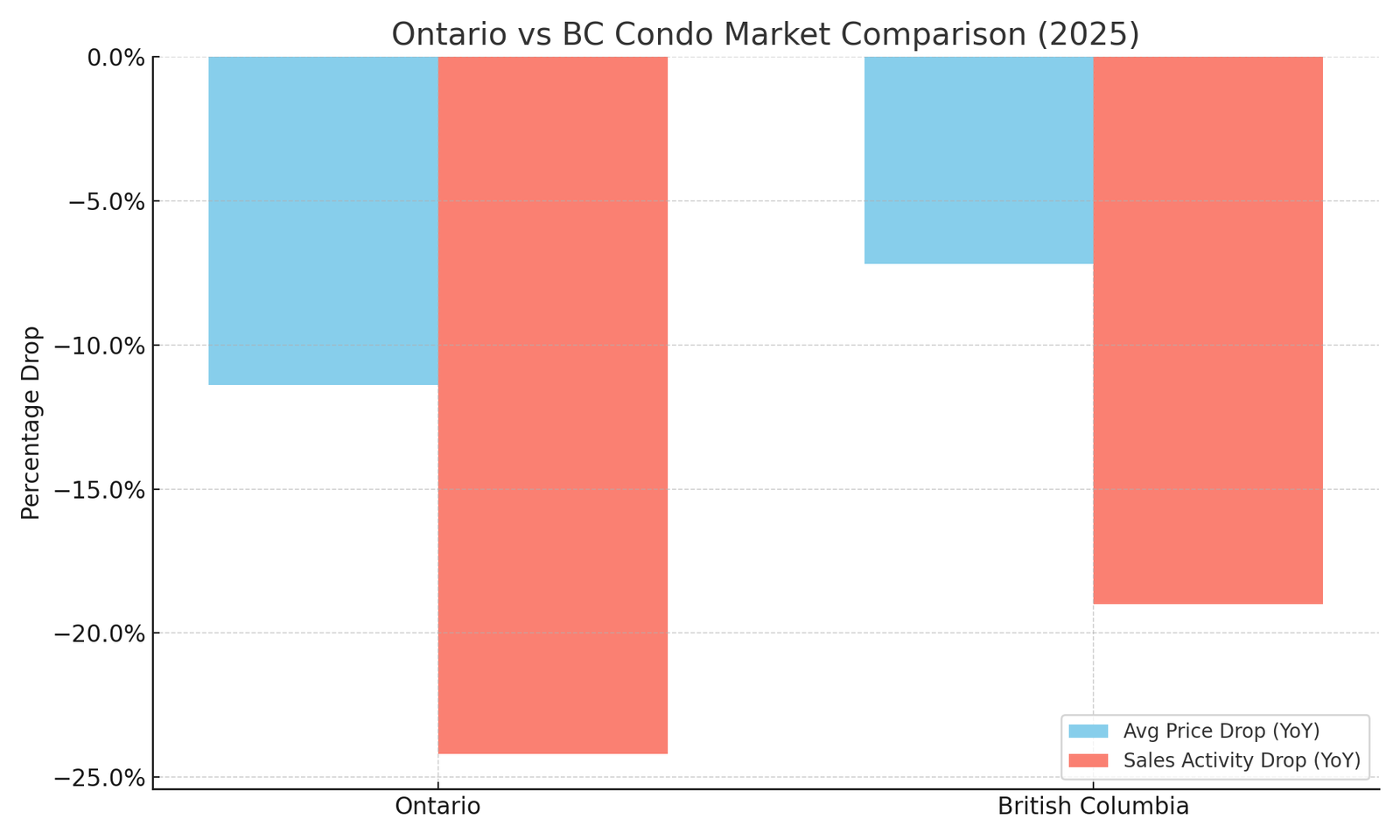

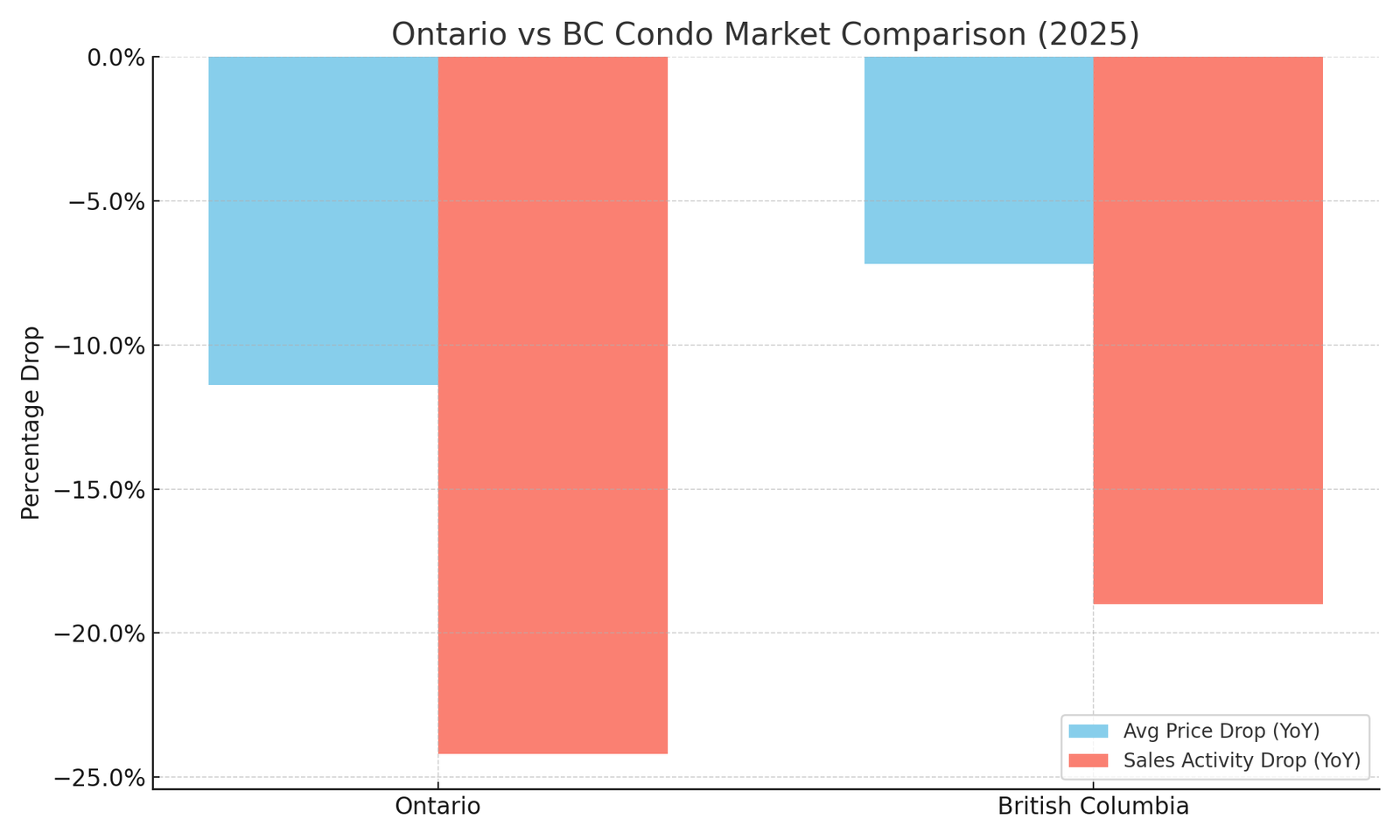

Ontario

Average Price Drop: -11.4%

Sales Activity Drop: -24.2%

Investor Confidence: Low

Notable Issue: Oversupply, stalled projects, high carrying costs

British Columbia

Average Price Drop: -7.2%

Sales Activity Drop: -19.0%

Investor Confidence: Cautious

Notable Issue: Inventory build-up, developer slowdown

Tenant expectations are shifting. Rental returns are narrowing.

And some regions are seeing more supply than demand. Whether you're a seasoned landlord or thinking of jumping in — here's what to watch in 2025.”

Let's dive into 2025’s side-by-side condo market comparison for Ontario (Toronto/GTA) and British Columbia (Metro Vancouver). Here's a breakdown of key trends, risks, and strategic insights for buyers and investors:

The slowdown in Canada’s condo market is expected to endure. New analysis from Canada Mortgage and Housing Corporation (CMHC) found that sales declined by 75 per cent in Toronto and 37 per cent in Vancouver over the past three years. Growing inventories have also led to reduced sale prices for buyers and lower rents as condo owners compete for rental cashflows.

BC and Ontario may share borders, but not rental trends.

Rising vacancy rates, stricter rules, and evolving renter priorities — it’s no longer about if your rental strategy needs a refresh, but how.

🔍 Tomorrow’s post will break it down — province by province.

Rising vacancy rates, stricter rules, and evolving renter priorities — it’s no longer about if your rental strategy needs a refresh, but how.

🔍 Tomorrow’s post will break it down — province by province.

📌 Save this if you manage a property or plan to become a landlord in 2025.

While buyers and renters currently have more negotiating power in Canada’s two most expensive condo markets, CMHC warns this temporary relief will put a strain on new supply.

“Given the national and global economic outlook, there is little evidence to suggest that price and rent declines are likely to quickly reverse,” CMHC states. “As a result, project cancellations and reduced construction activity are also likely to continue in the near term, hindering efforts to increase housing supply over the long term.”

Challenges with funding condo projects have some developers shifting to purpose-built rental unit construction programs that offer potential financing. Yet other developers are still cancelling an increasing number of condo projects.

“Given the national and global economic outlook, there is little evidence to suggest that price and rent declines are likely to quickly reverse,” CMHC states. “As a result, project cancellations and reduced construction activity are also likely to continue in the near term, hindering efforts to increase housing supply over the long term.”

Challenges with funding condo projects have some developers shifting to purpose-built rental unit construction programs that offer potential financing. Yet other developers are still cancelling an increasing number of condo projects.

What does this mean for landlords, Investors and tenants?

There are many reports of rising inventory, but not enough emphasis is being placed on the lack of new construction

Here are you Key takeaways:

Key Insights:

Average Price Drop: -11.4%

Sales Activity Drop: -24.2%

Investor Confidence: Low

Notable Issue: Oversupply, stalled projects, high carrying costs

British Columbia

Average Price Drop: -7.2%

Sales Activity Drop: -19.0%

Investor Confidence: Cautious

Notable Issue: Inventory build-up, developer slowdown

Tomorrow we are going to do a deep dive into what this means for Renters and landlords. Stay tuned.

Have any more questions?... ASK OLIVE - OUR 24 HOUR CONCIERGE