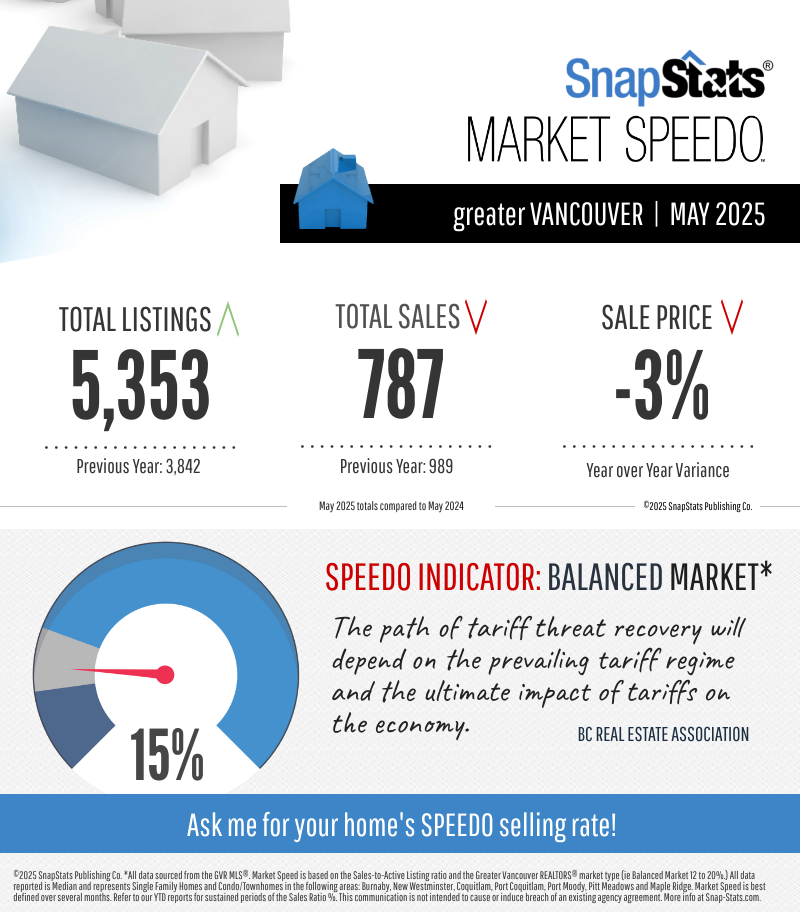

How to calculate land transfer tax

Land transfer taxes are calculated based on the purchase price of your property. Each province sets its own land transfer tax rates, as do some municipalities. Use the calculator below to find the land transfer tax based on your location, or keep reading to find out how land transfer tax is calculated where you live.

British Columbia first-time homebuyer land transfer tax rebate

British Columbia land transfer tax

Land Transfer Taxes in British Columbia are calculated in a similar way to Toronto, though with fewer property value brakcets. BC also levies a much higher marginal tax rate on high value residential homes.

Loading...

Loading...