🏠" WHAT I WISH ALL LANDLORDS KNEW" - Vol. 1 (Tenant Selection & Retention)

Posted on Aug 06, 2025 in Real Estate and Lifestyle

What I Wish All Landlords Knew… 🏠

The success of your rental business doesn’t start with rent cheques — it starts with the people you choose to hand your keys to.

The right tenant can bring stability, care, and long‑term value to your investment. The wrong one? Endless costs and headaches. In this volume, we’ll walk through the essentials of selecti...

Relocating, Renting or Investing in Port Moody?... Here's what you need to know

Posted on Aug 05, 2025

🔁 Considering a Relocation?- Considering Port Moody.?

Port Moody isn’t just a scenic detour outside Vancouver — it’s one of the Lower Mainland’s best-kept secrets. This once-sleepy waterfront town is now a rising star for homeowners, renters, and investors alike.

💭 Why Port Moody?

Here’s why:

✅ A strong community with a relaxed, small-town feel

✅ Direct...

✅ A strong community with a relaxed, small-town feel

✅ Direct...

📍PORT MOODY PRE-SALES: WHERE VIEWS MEET VALUE

Posted on Aug 01, 2025 in Real Estate and Lifestyle

For Investors. For Renters. For Relocators.

✅With 43M new home views on REW last month — the demand and interest for the stunning Port Moody area is loud and clear. The time to buy in Port Moody is now..

There’s a reason Port Moody keeps popping up on smart buyers’ radar — and it’s not just th...

B.C Powers Canada's 2025 Mid-Housing Growth - " Lets read between the headlines!"

Posted on Jul 31, 2025 in Real Estate and Lifestyle

WE’RE READING BEYOND THE HEADLINES

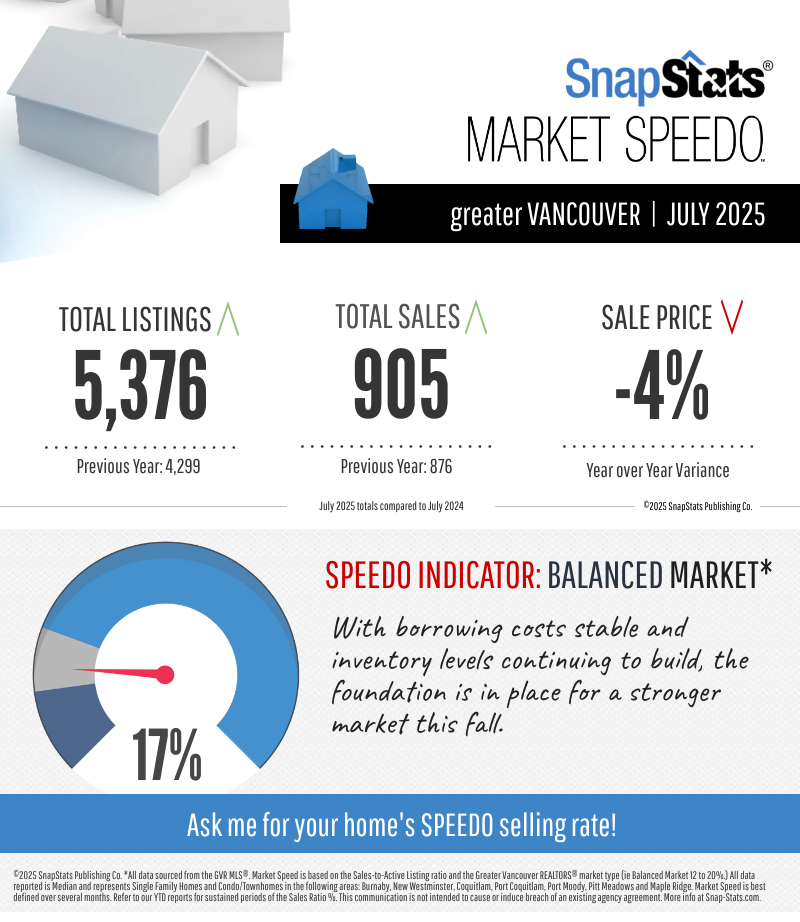

📊 BC Powers Canada's Mid-2025 Housing Growth... But It’s Ontario That Leads in Sales

BC is driving momentum, but not dominating. Ontario still commands the crown when it comes to volume.With BC posting a solid +5.8% sales gain in June—and Ontario close behind at +5.3%, there’s opportunity coast to coast.📍 Canada’s h...

BC is driving momentum, but not dominating. Ontario still commands the crown when it comes to volume.With BC posting a solid +5.8% sales gain in June—and Ontario close behind at +5.3%, there’s opportunity coast to coast.📍 Canada’s h...

📊 BC Powers Canada's Mid-2025 Housing Growth... But It’s Ontario That Leads in Sales

BC is driving momentum, but not dominating. Ontario still commands the crown when it comes to volume.With BC posting a solid +5.8% sales gain in June—and Ontario close behind at +5.3%, there’s opportunity coast to coast.📍 Canada’s h...

BC is driving momentum, but not dominating. Ontario still commands the crown when it comes to volume.With BC posting a solid +5.8% sales gain in June—and Ontario close behind at +5.3%, there’s opportunity coast to coast.📍 Canada’s h...07/30/2025 - Bank of Canada holds its key interest rate steady at 2.75%

Posted on Jul 30, 2025 in Real Estate and Lifestyle

Rate Hold, Not a Green Light.

The Bank of Canada held its key rate at 2.75% today while the U.S. tariff deadline hangs over August. Two forces now pull our market in opposite directions:

The Bank of Canada held its key rate at 2.75% today while the U.S. tariff deadline hangs over August. Two forces now pull our market in opposite directions:

- Imported‑inflation risk: Tariffs can lift input costs and weaken CAD—pushing fixed mortgage rates up before any BoC move.

- Domestic slowdown: A hold signals caution, n...