Exclusive market insights, pre-sale launches, and downsizing strategies—direct to your inbox.

No spam. Just strategy.

No matching listings at this time

No matching listings at this time

Click here to receive an email when matches become available!

Please select one or more areas to begin your search.

Please, provide an address, Postal code or MLS® Number

Get the 5 questions every downsizer needs to ask — before making the move.

Download Checklist

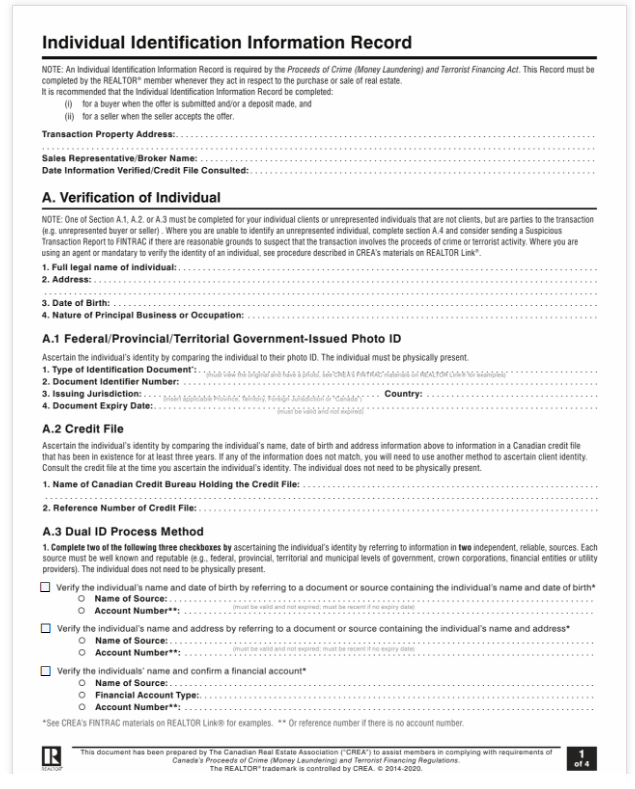

Due to the real estate sector's size, its services, and the high monetary values involved, real estate is at risk of being targeted for money laundering - as are banks and financial sectors where large transactions are common. One important way a real estate brokerage can reduce this risk is by regularly conducting an assessment to identify the factors that could expose them to this kind of crime.

Under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), the Financial Transactions and Reports Analysis Centre of Canada Risk (FINTRAC) requires each real estate brokerage to conduct an assessment and documentation of risks related to money laundering and terrorist financing, as well as mitigation measures to deal with those risks, and review it at least every two years or sooner, if risk factors change.

While there are specific legal requirements of brokerages around managing the risk of money laundering, REALTORS® also have an important role to play in combatting money laundering.

The Centre assists in the detection, prevention and deterrence of money laundering and the financing of terrorist activities. FINTRAC's financial intelligence and compliance functions are a unique contribution to the safety of Canadians and the protection of the integrity of Canada's financial system.

FINTRAC acts at arm's length and is independent from the police services, law enforcement agencies and other entities to which it is authorized to disclose financial intelligence. It reports to the Minister of Finance, who is in turn accountable to Parliament for the activities of the Centre.

Posted on Sep 09, 2025 in Real Estate and Lifestyle

Posted on Sep 07, 2025 in Real Estate and Lifestyle

Posted on Sep 04, 2025 in Real Estate and Lifestyle

That’s where A.H.O.M™ RMC...

That’s where A.H.O.M™ RMC...AHOM™ REALTY

BC: 2300-2850 Shaughnessy St, Port Coquitlam, BC. V3C 6K5 ONT: 236 Lake shore Boulevard E. Oakville, Ontario. L6J 1M9 ,