Closing costs are one-time fees that the buyer of real estate pays when they purchase a property.

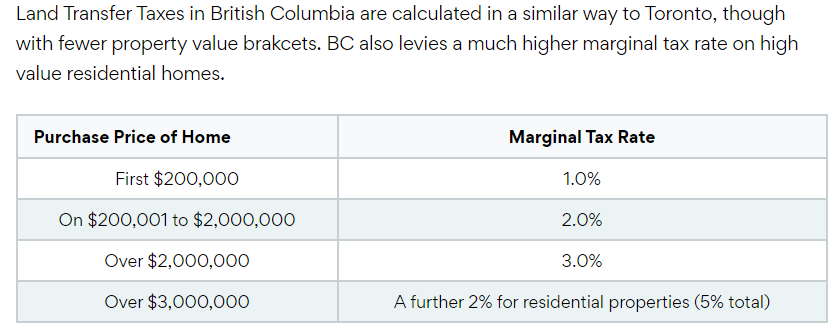

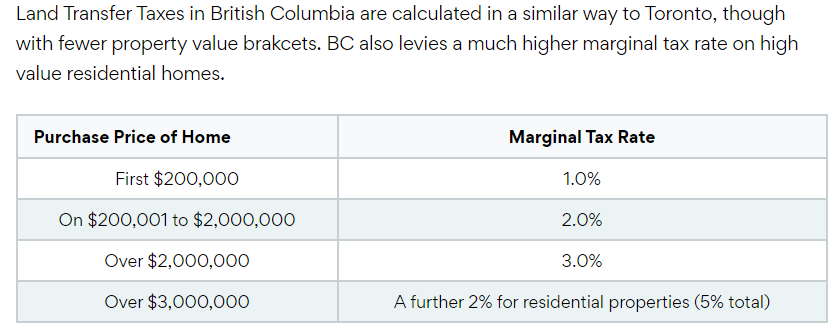

In British Columbia, buyers must pay a property transfer tax, which is based on the fair market value of the land and improvements. The tax is charged at a rate of 1% for the first $200,000, 2% for the portion of the fair market value that is greater than $200,000 up-to and including $2,000,000, and 3% on the portion of the fair market value greater than $2,000,000.

Currently, for new home buyers in other provinces, the GST payable is 5% of the purchase price, but most purchasers who buy a property for their own personal use (rather than as an investment property) may be entitled to a partial rebate of the GST, depending on the price and location of the property. Many builders include the GST in the purchase price, while others charge the GST in addition to the purchase price.

The tax amount is 20% of the fair market value of your proportionate share of the purchased property.

Closing costs is an umbrella term for the many various fees related to purchasing a home.

These costs include but are not limited to land or property transfer taxes, lawyer fees, inspection fees.

They have to be paid upfront and, in most cases, can't be rolled into your mortgage. Generally, it is a good idea to budget between 3% and 4% of the purchase price of a resale home to cover closing costs.

When purchasing a new home, in addition to the purchase price, legal fees, and disbursements, you will normally incur a number of additional expenses, including Land Transfer Tax (Also known as Property Transfer Tax) , the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST), and adjustments.

Land Transfer Tax (Land transfer tax in British Columbia, also known as property transfer tax, is a provincial tax that is charged upon completion when title on a property is transferred.)

One of the largest additional expenses when purchasing real property is the provincial land transfer tax. The amount the purchaser pays is set by each province, and in some cases, municipalities, and is usually calculated according to a schedule based on the purchase price of the property.In British Columbia, buyers must pay a property transfer tax, which is based on the fair market value of the land and improvements. The tax is charged at a rate of 1% for the first $200,000, 2% for the portion of the fair market value that is greater than $200,000 up-to and including $2,000,000, and 3% on the portion of the fair market value greater than $2,000,000.

There is no tax payable by the seller.

Property transfer tax should not be confused with annual property taxes. Annual property taxes are paid yearly to your municipal or rural tax office for each property you have a registered interest in to fund services in your area.

A first-time home buyer may qualify for a rebate of the tax from the provincial government.

A first-time home buyer may qualify for a rebate of the tax from the provincial government.

When is PTT Payable on Property Sales in British Columbia?

Again, upon Completion of the Contract of Purchase and Sale (Subject Free Accepted Offer) at the Land Titles Office.

Again, upon Completion of the Contract of Purchase and Sale (Subject Free Accepted Offer) at the Land Titles Office.

When you own or lease a property or manufactured home in B.C., property taxes must be paid yearly for each property. The amount you pay is based on the funds needed to provide services for the year. Tax rates are set to determine how to share the cost of providing the services.

How are property taxes calculated?

Once a year, municipalities across the country assess and determine their property tax rate, which is usually somewhere in the range of 0.5 to 2.5%. Some people assume their annual property taxes are based on the size of their property, but that’s not exactly true.

Once a year, municipalities across the country assess and determine their property tax rate, which is usually somewhere in the range of 0.5 to 2.5%. Some people assume their annual property taxes are based on the size of their property, but that’s not exactly true.

our municipality’s property tax rate is multiplied by the market value of your home (not the purchase price), which can vary year-to-year based on the value of surrounding properties.

So you would owe $4,875 in property taxes to your municipality that year.

- GST / HST on the purchase price of new homes

Currently, for new home buyers in other provinces, the GST payable is 5% of the purchase price, but most purchasers who buy a property for their own personal use (rather than as an investment property) may be entitled to a partial rebate of the GST, depending on the price and location of the property. Many builders include the GST in the purchase price, while others charge the GST in addition to the purchase price.

If your purchase includes appliances, furniture, or other items that are left in the home, you may also have to pay the retail sales tax on the value of these items in provinces that have provincial sales tax.

- Additional Property Transfer Tax for Foreign Buyers

The tax amount is 20% of the fair market value of your proportionate share of the purchased property.

In addition to the information above- there are several rebates you can qualify for.

Click through the taxes title links above for more full in depth coverage of the taxes.