National forecast: Home prices are expected to decline 2–3% in 2025, with Ontario and BC leading the downside due to trade uncertainties and demand softness. Moderate recovery anticipated by 2026–27

BC’s outlook: Prices likely to remain stable or slightly decline until stronger demand or rate relief emerges

Ontario projections: Continued slow demand, increased listings, and price declines softened by rent growth and selective neighbourhood interest in Halton, GTA premium segments

🏠 August 01 2025 Market Update — British Columbia & Ontario

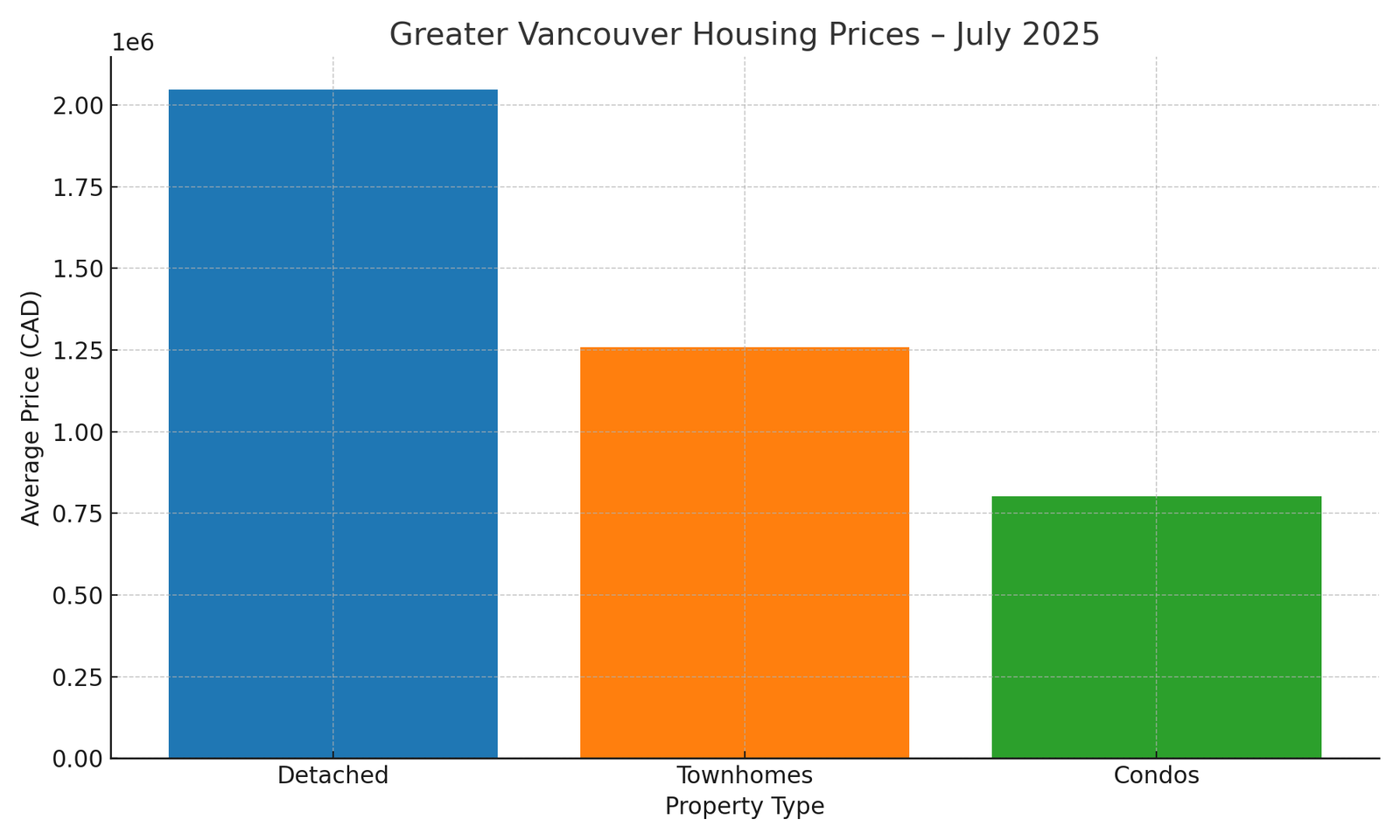

🌲 British Columbia – Metro Vancouver

Median list price (July): $1,463,434 (↓0.7% MoM vs. June’s $1,473,736)

Benchmark price (June): $1,173,100 (↓2.8% YoY)

Active listings: 17,561 (highest on record; ↑≈24% YoY)

SNLR (Sales-to-New-Listings Ratio): ≈35% → buyer’s market territory

🔍 Insight: Prices are holding near $1.17M with inventory swelling. This gives buyers more options and negotiation leverage than we’ve seen in years.

🍁 Ontario – Halton Region (Oakville & Burlington)

Oakville average sold price (last 28 days): $1,311,713 (↑10.6% MoM; ↑8.6% QoQ)

Halton Region average (June): $1,210,534 (↑14.5% YoY; ↓4.6% MoM)

Burlington (June): Residential sales down ~4.3% YoY; inventory rose 27%, increasing months of supply to 3.83 (highest in a decade) — strong buyer advantage.

🔍 Insight: Oakville remains high-end and active, while Burlington’s increased inventory and slowing sales give buyers more room to negotiate and consider options.

📊 Market at a Glance

| Region | July Price | Trend YoY | Inventory Status | Buyer vs Seller Market |

|---|---|---|---|---|

| Metro Vancouver (BC) | ~$1.17M (benchmark) | ↓2.8% YoY | Record-high listings | Buyer's market (SNLR ~35%) |

| Oakville (Ontario) | ~$1.31M | ↑10.6% MoM; ↑8.6% QoQ | Inventory rising | Balanced to selective seller market |

| Burlington (Ontario) | Halton avg ~$1.21M | ↑14.5% YoY, ↓4.6% MoM | High months-of-supply (~3.8) | Strong buyer leverage in many segments |

📉 Broader Trend Update

National forecast: Home prices expected to decline ~2% in 2025, with stabilization & modest recovery in 2026. Ontario and BC are leading the trend.

Continued high inventory and cautious buyer sentiment suggest ongoing negotiation power for purchasers through fall 2025.