Canada may be preparing to eliminate up to 57,000 federal public service jobs by 2028, with steep cuts targeted at major departments and the Ottawa‑Gatineau region in particular The Economic Times.

As the economic calendar tightens and confidence wanes, public-sector uncertainty is poised to ripple through the housing market—especially in urban areas reliant on federal employment.

🏘️ Condo Market in Crisis

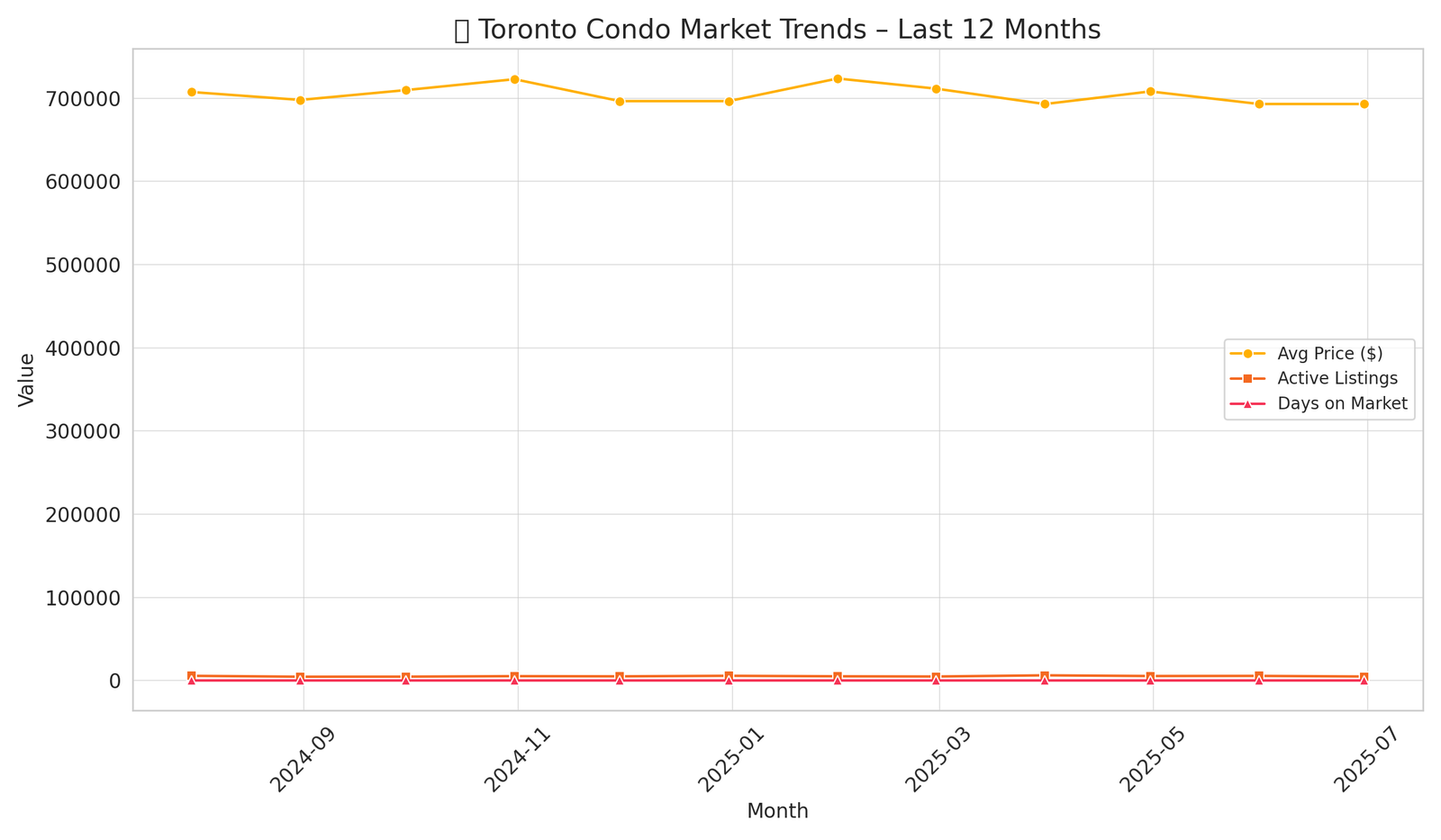

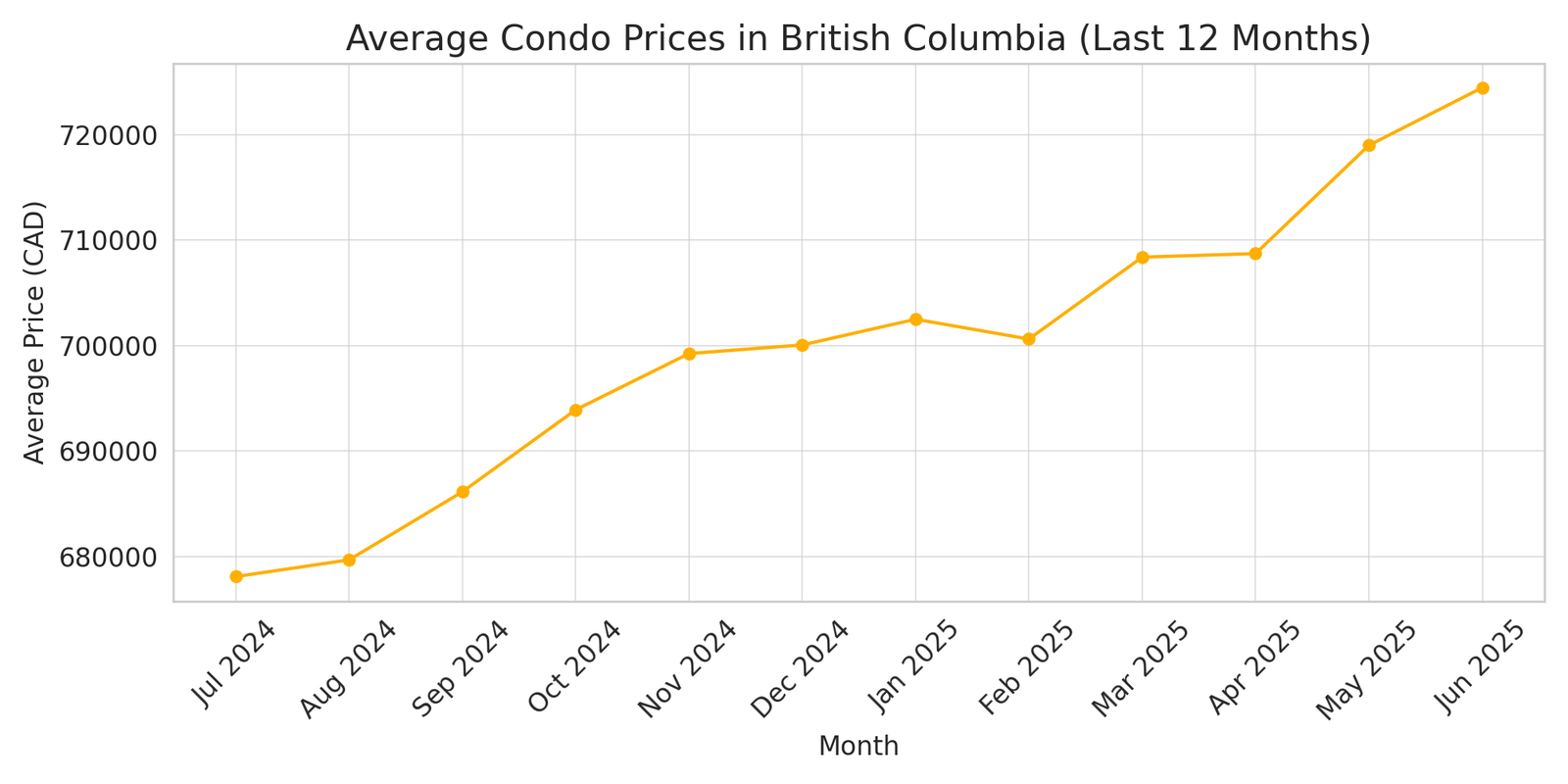

The Canadian condo sector has taken a real hit:- Toronto condo sales dropped 75% from mid‑2022 to early 2025, while Vancouver fell 37% LinkedInNerdWallet+5Newswire+5Mortgage Rates Canada+5.

- As supply surged, resale condo prices plunged — roughly 13.4% in Toronto and 2.7% in Vancouver over the same period TD Economics+3Mortgage Rates Canada+3NerdWallet+3.

- Many investors now face carrying costs up 24–29% but rental growth is lagging far behind at 12–15% Mortgage Rates Canada.

⚖️ Macro Outlook and Forecasts

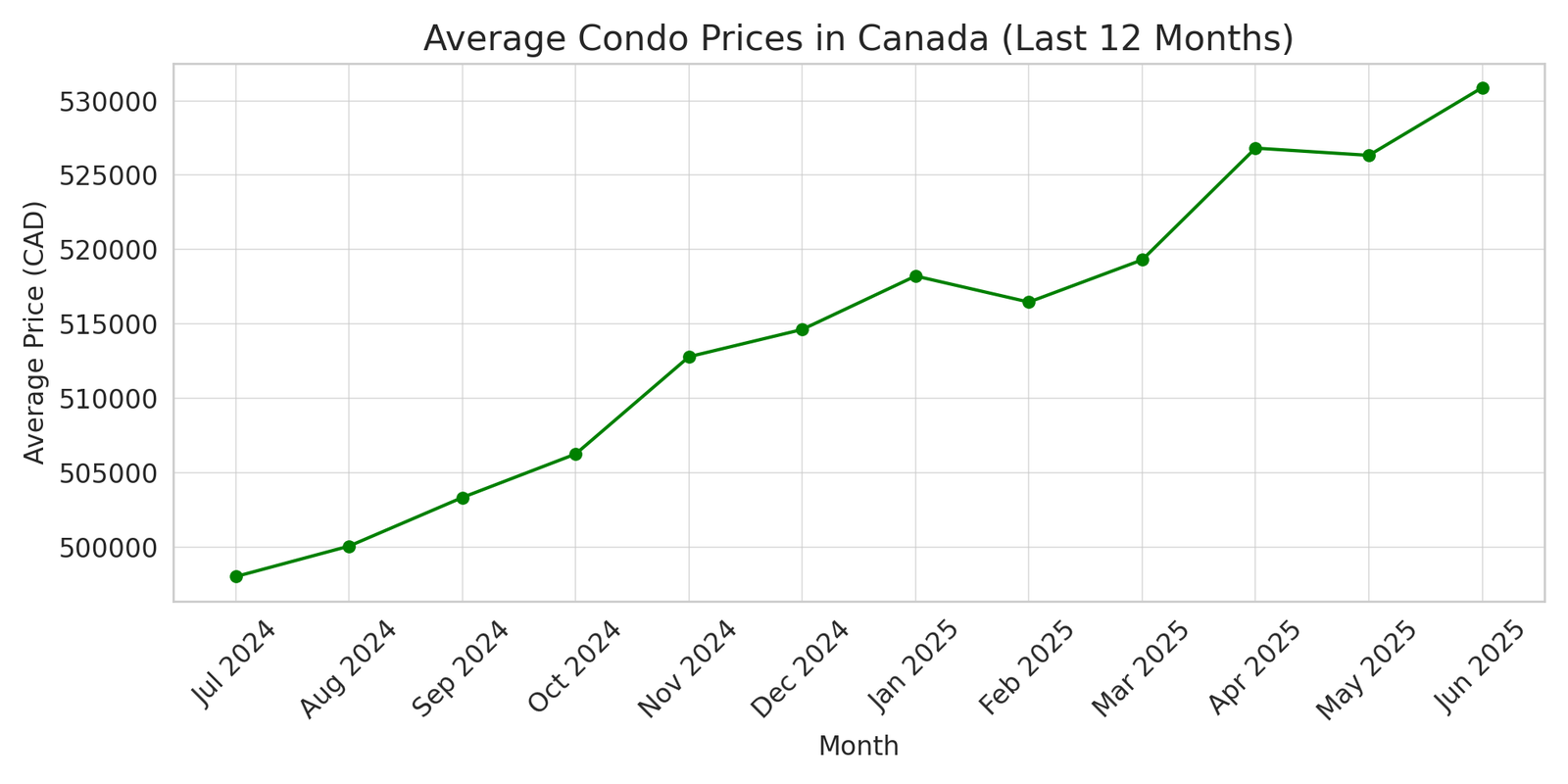

- The federal housing agency (CMHC) now sees a ~2% national home-price drop in 2025, with deeper declines in Ontario and B.C.

- Home sales dipped roughly 6.6% in H1 2025 but may rebound modestly later in the year TD Economics.

- The expected recovery hinges on lower mortgage rates, easing trade tensions, and improving consumer confidence

🧱 Impact on the Real Estate Market

A shrinking federal payroll may:- Hit buyer confidence and delay move-ups, especially in job-heavy regions like Ontario and Ottawa.

- Exacerbate sluggish condo markets already burdened by oversupply.

- Stall investor activity and stall upgrades from condos to homes due to erosion of equity.