Understanding land taxes in British Columbia real estate

Land transfer tax in British Columbia, also known as property transfer tax, is a provincial tax that is charged upon completion when title on a property is transferred.

It is important that you are well aware of closing costs associated with purchasing, and this blog will help to explain the land transfer tax details and how much you’ll need to pay.

Eligibility

You can qualify for the first-time homebuyer land transfer tax rebate if:

- You are Canadian citizens or permanent residents as determined by Immigration Canada

- You have lived in British Columbia for 12 consecutive months prior to the date the property is registered or have filed 2 income taxes in British Columbia in the 6 years before the property is registered

- You have never owned an interest in a principal residence anywhere in the world at anytime

- You have never received a first-time homebuyers' exemption or refund

- Your property qualifies for the first-time homebuyer land transfer tax rebate if:

- The fair market value of the property is less than $500,000

- The land is (0.5) hectares or smaller

- The property will only be used as your primary residence

Additional Property Transfer Tax for Foreign Buyers READ HERE

In addition to the above property transfer tax, foreign buyers (those that are not Canadian citizens or permanent residents) are subject to an additional land transfer tax that is calculated as follows:

The tax amount is 20% of the fair market value of your proportionate share of the purchased property.

Land Transfer Tax BC First Time Home Buyer Exemption – Full Rebate Increased to $500,000

To help enter in to the market, the first time home buyer’s (FTHB) program gives an exemption to the property transfer tax in the case that you can qualify.

You qualify for a full refund if:

To help enter in to the market, the first time home buyer’s (FTHB) program gives an exemption to the property transfer tax in the case that you can qualify.

You qualify for a full refund if:

- You are a Canadian citizen or permanent resident;

- You’ve lived in BC for 12 consecutive months before the date the property is registered; or

- You’ve filed 2 income tax returns as a BC resident in the last 6 years;

- You have never owned an interest in a principal residence anywhere, anytime; and

- You have never received a first time home buyers’ exemption or refund.

- Your property meets the exemption requirements as well.

- The property does not have a fair market value that exceeds $500,000

- The property will be used as a principal residence for a minimum of 1 year.

Land Transfer Tax Rebate

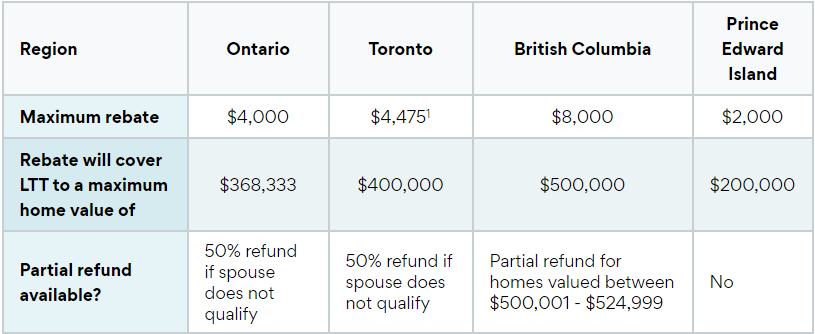

In some provinces and cities, there is a rebate available to help first-time homebuyers offset the cost of their land transfer tax. If you qualify, land transfer tax rebates are available to first-time homebuyers in the provinces of Ontario, British Columbia, and Prince Edward Island.

In some provinces and cities, there is a rebate available to help first-time homebuyers offset the cost of their land transfer tax. If you qualify, land transfer tax rebates are available to first-time homebuyers in the provinces of Ontario, British Columbia, and Prince Edward Island.

Here’s how each province and city’s rebate works:

Partial land transfer tax rebate:

There are also partials exemptions for properties that are between the value of $500,001 – $524,999.

There are also partials exemptions for properties that are between the value of $500,001 – $524,999.

For properties above $525,000 there is no exemption even if you are a first time home-buyer, you will be subject to paying the entire property transfer tax amount.

These are all of the land transfer tax BC numbers as of 2021.

These are all of the land transfer tax BC numbers as of 2021.

If you are looking at another article that was published prior to February 22, 2017, then the previous rates were a max of $475,000 and a partial up to $500,000.

Since then, these amounts have increased to the current numbers previously noted.

Application for First Time Home-Buyers

Because there are very specific requirements to be eligible for the rebate, a first time home-buyer must apply for the First Time Home Buyer’s Program, select, or enter exemption code FTH on the property transfer tax return.

After you have applied you must meet additional requirements during the first year you own the property to keep the tax exemption.

Application for First Time Home-Buyers

Because there are very specific requirements to be eligible for the rebate, a first time home-buyer must apply for the First Time Home Buyer’s Program, select, or enter exemption code FTH on the property transfer tax return.

After you have applied you must meet additional requirements during the first year you own the property to keep the tax exemption.

First Time Home Buyer Property Transfer Tax Exemption

To help enter in to the market, the first time home buyer’s (FTHB) program gives an exemption to the property transfer tax in the case that you can qualify.

You qualify for a full refund if:

To help enter in to the market, the first time home buyer’s (FTHB) program gives an exemption to the property transfer tax in the case that you can qualify.

You qualify for a full refund if:

- You are a Canadian citizen or permanent resident;

- You’ve lived in BC for 12 consecutive months before the date the property is registered; or You’ve filed 2 income tax returns as a BC resident in the last 6 years;

- You have never owned an interest in a principal residence anywhere, anytime; and

- You have never received a first time home buyers’ exemption or refund.

- Your property meets the exemption requirements of being used as a principal residence; has a fair market value that does not exceed $500,000; and the land is equal to or less than 0.5 hectares (1.24 acres)