Metrics define the residential real estate queries that areas and statistics come up against. Some are counts, some are calculations. All SnapStats calculations are median. All data in our Reports is based on the MLS ‘processed date’ which is the same variable used by the REBGV and FVREB for their statistic packages and dynamic reporting. Therefore our data can be verified against both board’s data.

Median

The median value is one of the most common measurements used to compare real estate prices and other data in different markets, areas and periods. It is said to be less biased than the mean (average) price since it is not as heavily influenced by small numbers of very highly priced home sales, or extraordinarily low priced home sales. SnapStats therefore subscribes to the principle of median measurements for data reporting purposes as requested by Managing Brokers and recommended by university professors.

Sales Price

Calculations are based on MLS sold data and ‘processed date’ (not sold date.)

Sale Price to List Price %

Percentage found when dividing a listing’s sales price by its original list price, then taking the median for all sold listings in a given month. Calculations are based on MLS sold data.

Days on Market

Median number of days between when a property is listed and when an offer is accepted in a given month. Calculations are based on MLS sold data.

Price Per Square Foot

Calculations are based on MLS sold data. Calculated by taking a median of closed sales price divided by square footage for each individual listing in the current period. Calculations are based on sold data.

Inventory (Active Listings)

The number of properties available for sale in active status on the first business day morning of each month with a maximum list date from the preceding month end. Calculations are based on MLS listing data.

Sales

A count of the actual sales that closed in a given month. Calculations are based on MLS sold data.

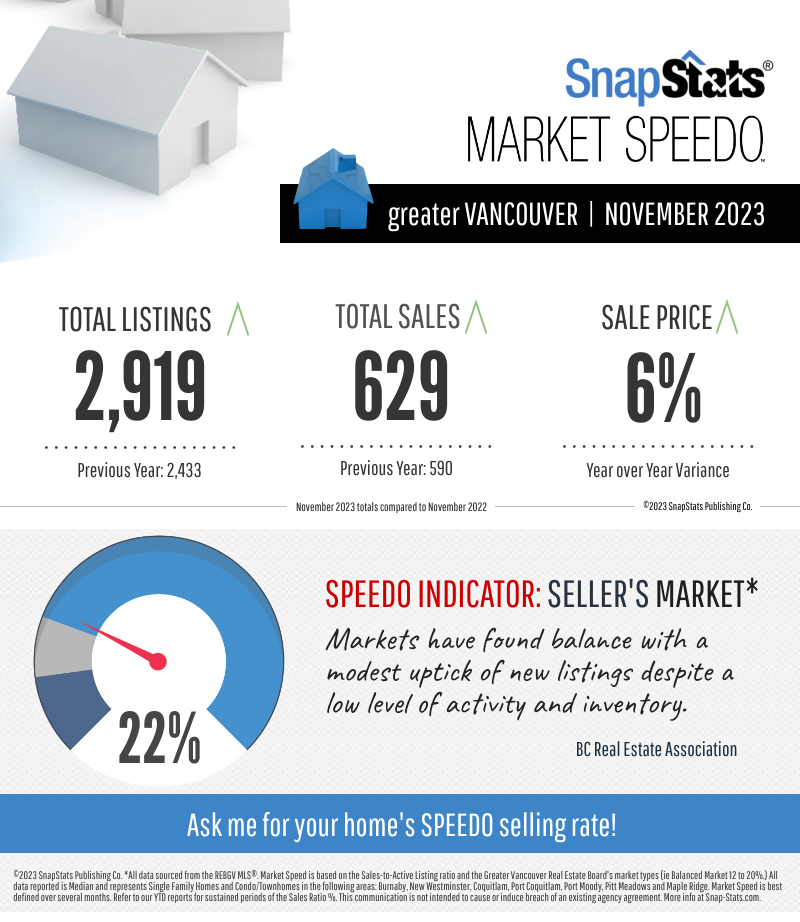

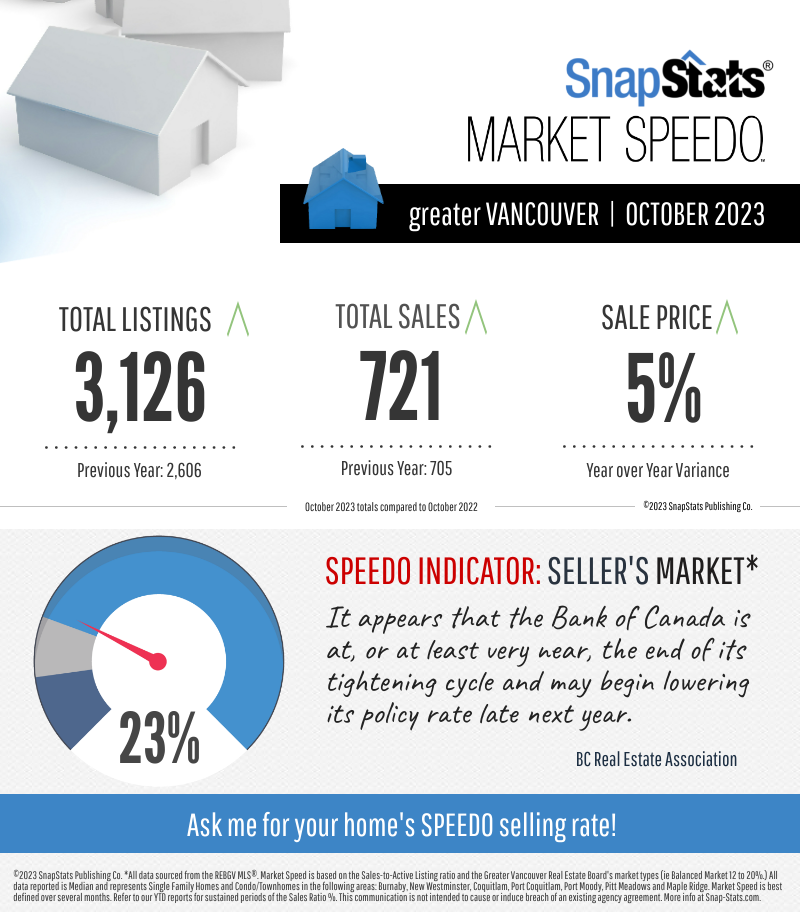

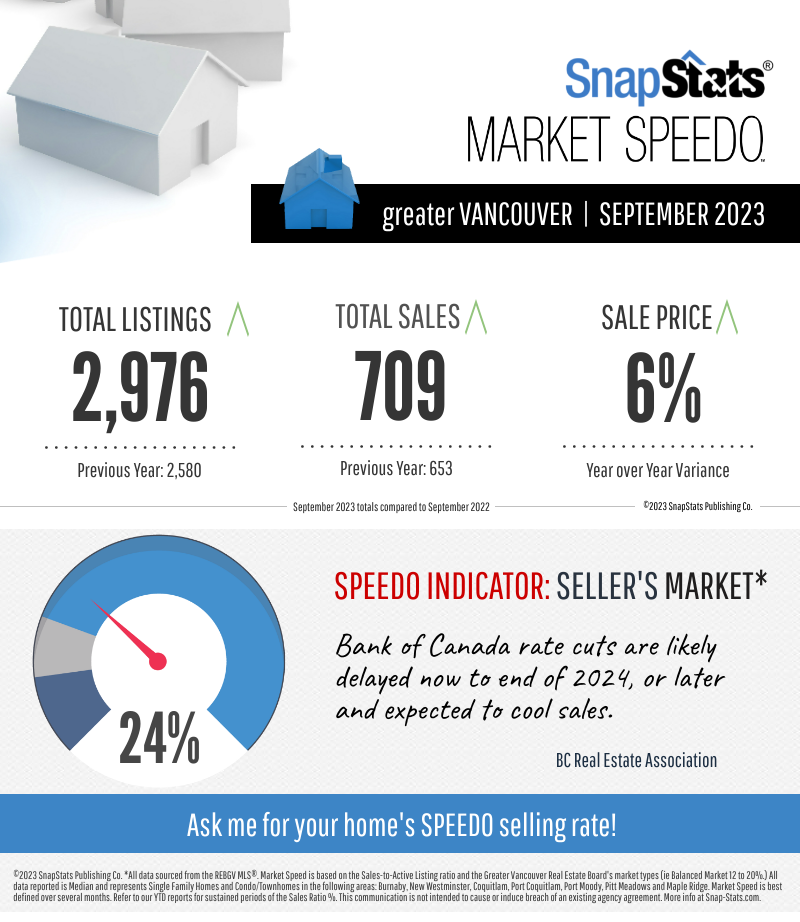

Sales Ratio % (based on the Sales-to-active listing ratio)

The number of home sales divided by total active inventory for the specified period. Calculations are based on MLS sold and active listing data. Helps identify the market type such as Seller, Balanced or Buyer. Is indicative of the speed of homes selling (higher the number, faster the market) and percentage of homes selling.

MLS HPI Price (not represented in our reports)

The MLS Home Price Index (HPI) measures the rate of price change of housing features. Thus, the HPI measures typical, pure price change (inflation or deflation) and reflects general trends in the market place. It is for this reason that the HPI is not used in our reporting as we drill the data down to the point that the HPI cannot be applied (in fact the data is not even available.)